How to make a business plan for online investing

Do you really need a business plan when investing online? I thought I didn’t, until my way of living interfered with my investments and severely affected the efficiency and results of my investing. Yesterday I discussed how to fit online investing in your daily schedule and towards the post’s end I suggested making a plan before investing your first dime. So, today I thought to pick up where we left off and see how to make a business plan that will guarantee less stress while investing online.

First and most importantly we have to decide what kind of investing we are interested in. As we explained yesterday, our daily schedule will greatly influence our decision. But it’s not just our family duties or day job that will force us to give up some of the options available. Investing is about making money, correct? So, shouldn’t we first find out if we can actually make money by investing online?

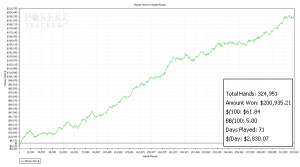

We have heard stories that there are people making a living from gambling. Sorry, I meant to say investing. In fact, investing and internet gambling can mean the same thing! Anyway, traders, bettors and poker players brag about theirprofits, so they seem to be able to make money out of stock trading, sports betting or online poker. I regard all of them as investors. Actually the ones that beat their game. Because the rest of them just give away their money to online brokers, stock and sports exchanges and to the opposition. We don’t want to be one of those (chances are you are going to fail in the beginning), we should really try and belong to the elite group of winners.

So, we spend a lot of time studying books, reading endless forum threads and finally come up with a proven, confirmed and verified winning strategy (backtesting your system is absolutely paramount). According to that strategy and in combination with our daily schedule we can now answer the following questions confidently:

- Will we trade stocks?

- Does forex trading appeal to us?

- Should sports betting be our top priority?

Those are some of the online investing ideas for income. You may have found some other kind of investing (photography maybe?) where you do have an edge and you are able to exploit your opponents. Remember, other people must lose money before you begin making some, so you need to be better than your opponents, whatever the investment (even in photography, customers buying photos from a newcomer such as yourself (bringing new ideas and techniques) means that established professionals will experience a decrease in sales).

Now that we do know we have the time and way to make money investing online, let’s move on and write a business plan. Nothing too fancy, a draft business plan will do just perfectly.

Don’t get worried of the term “business plan”. It’s just a plan that will keep you on track during the bumpy ride of online investing! There will be downswings and drawdowns that will test your discipline and patience, not to mention your financial security!

How to make a business plan for investing online

- Write down how many hours you are expecting to spend investing online per investing day. Remember, you already did that when you organized your daily schedule. Also an investing day for stock trading is a day when the stock market is open, while investing days for sports betting should mostly be Saturdays.

- How many investing actions will you take during those hours? In other words, how many stock or forex trades are you going to make, how many bets are you going to place? Count the times you are risking money.

- Calculate the average risk per investing action. That is the money you are supposed to lose if the stock price plummets or if the team you picked loses the game.

- Multiply the number of actions per day with the average risk. You now know how much money you are going to risk through the day. That number is known as daily turnover or just turnover.

- Calculate your daily expected profit. It’s not as hard as it sounds. You just multiply the turnover with your edge (percentage). You did calculate your edge, right? If not, go back to your investing strategy. There are crucial things missing. So, for example if your edge is 1 per cent and your daily turnover is a thousand dollars, you are expected to make 10 dollars per day. The size of the edge differentiates in accordance with the investment.

- Finally multiply that expected profit with the investing days of the month for the expected monthly income. 12 times that equals to your expected profit by the end of the year.

Our business plan for online investing now includes the following key metrics:

- Type of investment.

- Time spent.

- Expected income.

According to our business plan, we are an investor of X/Y/Z, who needs T hours per month to make M dollars per month. Was that too difficult? Surely it was much easier than finding your edge and developing a winning strategy! Yet, so many investors neglect writing down a business plan and have no idea where they stand by the year’s end. I suppose it’s not that they don’t know how to make a business plan, rather than not seeing the point of it.

[box type=”warning”] Don’t forget, online investing is like any other business, that is why we need a business plan![/box]

This business plan will also raise flags in case the strategy underperforms, leading us to revisit it and possibly make some changes. You know that saying?

Adapt or die

The stock markets and the gambling world is a living creature, always developing, always changing. If we do not adapt, our winning system will experience decreased profits or it may convert into a losing one! Once upon a time a “buy and hold” strategy was sufficient to show a profit in stock trading (I guess), 3betting preflop increased the winrate enormously in online poker, trading horse racing betting odds was easily done than said (or shown). And if we don’t have a business plan because we haven’t spent 5 minutes to learn how to make a business plan, we are driving towards a cliff without even knowing it! So, write down a business plan and also a backup plan, just in case your investing career ends prematurely!

Member discussion