Let’s say a few words about Bitcoin today and why someone should monitor Bitcoin’s price.

Bitcoin. What is it, how did all start, what’s its use; these are questions that have been answered by many others and I won’t deal with. For me, Bitcoin is yet another symbol which I can invest in, such as the euro sign (€), the Microsoft stock ticker symbol (MSFT) and ticker symbols of oil and coffee.

Some of them represent commodities, some companies and some currencies. The list can be truly endless.

How to trade Bitcoin and invest in general

So, the Bitcoin is a currency which does not exist in physical form, though. It serves, however, some purposes, depending on which, Bitcoin’s supply and demand are created. It is this supply and demand that makes Bitcoin’s price fluctuate and create its chart.

There are two reasons you’ll want to invest in Bitcoin but also in any other asset or security. First, come the fundamental reasons and second, the technical ones.

What it Bitcoin for, who uses it, which countries allow it, which organizations prefer it, what’s Bitcoin’s creation principle, which new technology adopts it, these are questions of fundamental analysis.

How does the chart look like, how do we interpret the chart’s lines, where was the last support, how far are we from all-time highs, did it print a new high, what do RSI, MACD and moving averages hide, these are questions of technical analysis.

Personally, I mainly use technical analysis. So, I rarely deal with fundamental analysis’s matters. More often than not, the lack of knowing basic stuff of my investment is quite common.

For example, when I was trading the betting odds of UK horse racing markets (yes, there are videos for this as well) I found out many months later, that there were hurdles in the racetracks and that’s why horses fell down!

Other examples are my numerous investments in stocks for which I have never checked out balance sheets or have I laid an eye on the company’s history, their products or their competition!

Ideally of course, one must combine these two types of analyses.

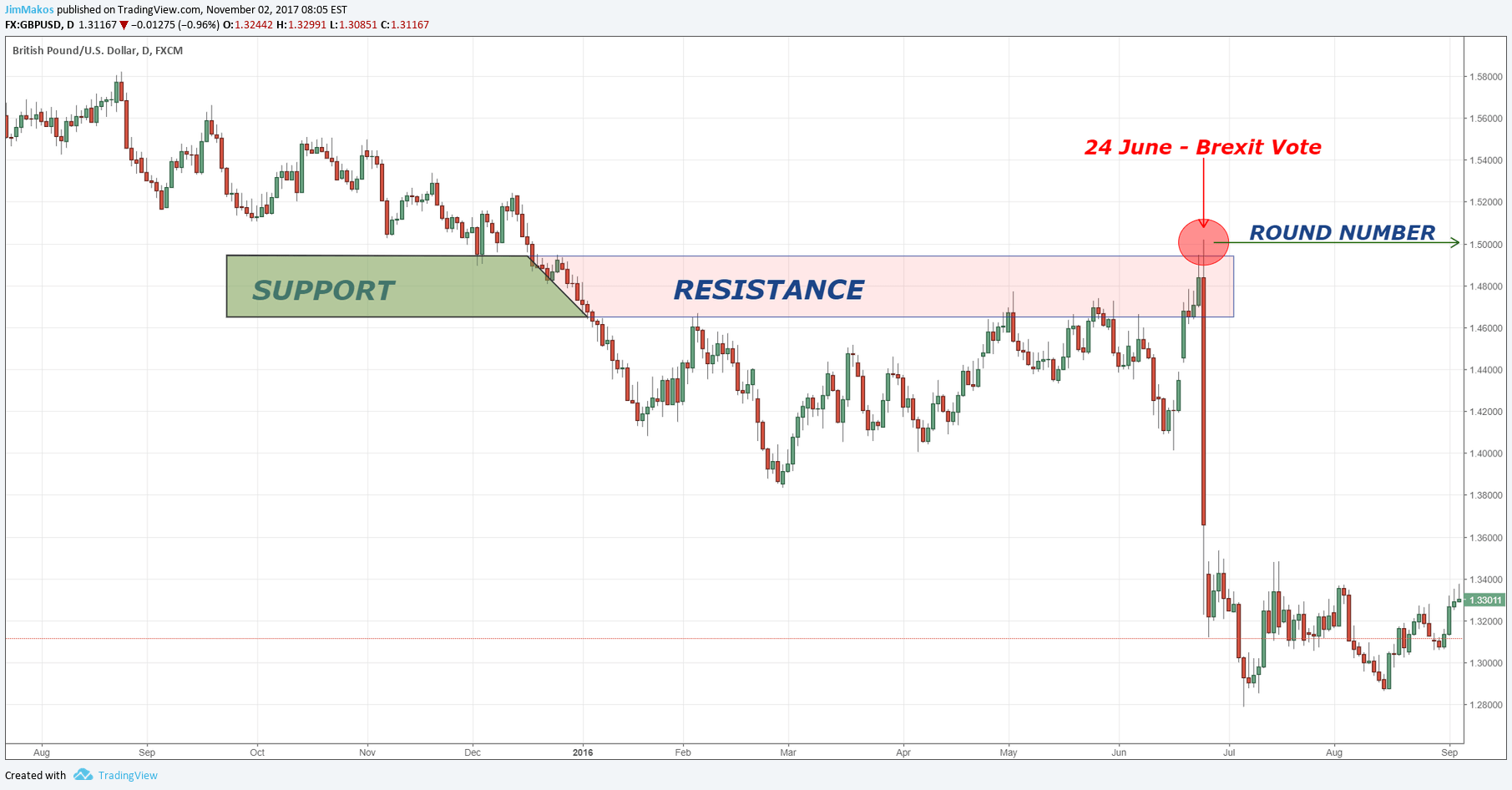

A prime example is the UK referendum and its influence on Sterling’s price. On one hand we had a historical event that took markets by surprise (remember that panic creates opportunities) and on the other hand, Sterling’s exchange rate against the US dollar was trading on a key resistance level. The combination of these two events created an unprecedented opportunity which still increases the profits of those who seized it.

So, back to the Bitcoin topic, the bullish chart is quite clear. Years later, it’s quite possible we’ll be talking about the biggest bubble of all time. But until it bursts (if it bursts) one would have a hard time betting against this trend, which, may I remind you, is created due to the supply and demand. Simply put, It is a psychological battle between investors.

On the other hand, this supply and demand arise from major events and latest developments concerning the cryptocurrency. Another part of supply and demand is due to Bitcoin’s white paper, let’s say the initial declaration of the Bitcoin’s creation.

Investing in Bitcoin and other cryptocurrencies

Perhaps you’ve heard of many other crypto coins that have been released recently. Think of them as new companies, as new startups, as new ideas which are laid down on their white papers. Each idea of them is funded via a new crypto coin, in the same fashion a new company seeks funding in its first steps or increase its capital and value through its offering in the stock market.

Perhaps it’s not by accident that crypto coins attract investors via ICOs, that is Initial Coin Offerings, reminding us of the companies’ IPOs, ie the Initial Public Offerings, which in Greece we are used to call it a public listing in the stock market.

In the end, Bitcoin is for me just another vehicle among the thousands that exist to invest a part of my capital. I admit that due to the high risk of this investment, I risk a very small part of my money. However, it is still an investment. Who knows, maybe it ends up the most profitable one which will make it up for many others that cost me money.

But even if it proves a bubble, the loss I will sustain should not be bigger than any other investment. We will talk about proper risk management in another episode.