Bank runs, insolvencies, and a looming economic crisis. Again.

This week's news may sound a bit overwhelming for some of you. So I thought of getting you up to speed on what I learned as a gambler myself about the turmoil in US banks and explaining what's going on in less than 5 minutes!

In layman's terms, like degenerate gamblers, the banks placed a bet some time ago that interest rates would not go up. That bet didn't pay off since central banks kept raising their rates to combat inflation caused by printing money for a decade. Remember the helicopter money during the pandemic?

And they are losing a lot of money because of that bet. Even worse, the money they lose isn't theirs! It's their depositors!

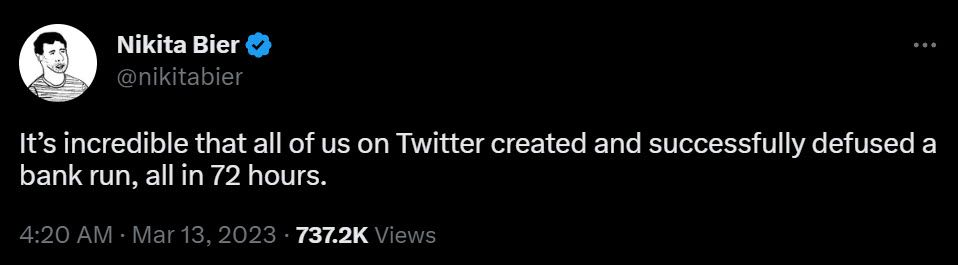

Now, guess what happens when the word is out in the street, and people ask for their deposits? Banks do not have enough cash for withdrawals because of that bet!

I’ve never seen a bank run in Brentwood Los Angeles in over 40 years — this is at first republic bank branch. People standing in rain pic.twitter.com/k31PqqpyO3

— pjb.eth (@Dr_PhillipB) March 11, 2023

Here's why. Again, very simply put by a Greek guy who is all too familiar with his country's debt crisis: