Three words: VAT, currency rates.

I am based in Greece, a small country in the South Europe often making into the headlines for its sovereign debt and economic crisis. Greece is a member of European Union and much like other European countries, we use the Euro currency for buying and selling stuff.

Euro is quite expensive compared to US dollar.

Another common characteristic with other members of EU is that we pay VAT, standing for Value-added tax, in about every transaction we make. The VAT rate isn’t the same everywhere and fluctuates between 15 and 25% more or less. Therefore, every time we buy something, we pay 23% VAT here in Greece.

Europeans pay VAT even when buying online.

Sellers are obliged to charge the corresponding VAT, depending on the buyer’s country of origin. So, if I order something from Amazon and my billing address is in Greece, Amazon.co.uk charges me 3% more (UK’s VAT rate is 20%) and Amazon.de adds 4% (Germany’s VAT rate is 19%).

Of course, things get even more expensive if Europeans order from US-based Amazon or Asian dealers due to customs. We get a “look but don’t touch” feeling whenever we stumbled into a product that is sold remarkably cheaper overseas, such as digital cameras.

Did I mention that USA has no federal VAT and only state-specific sales tax?

If you are a Europe-based photographer, you need to move to USA

Not just because of the cameras, lenses and other gear found cheaper on the other side of the Atlantic, but because of the cost of online services and software. Although I’m not a photographer, I think the following example quickly demonstrates why establishing a startup in USA is cost-effective among other things.

You all have heard of Photoshop. Recently, Adobe introduced Creative Cloud. Filmmakers, illustrators and photographers can acquire licenses for the complete Adobe product line in a more affordable way.

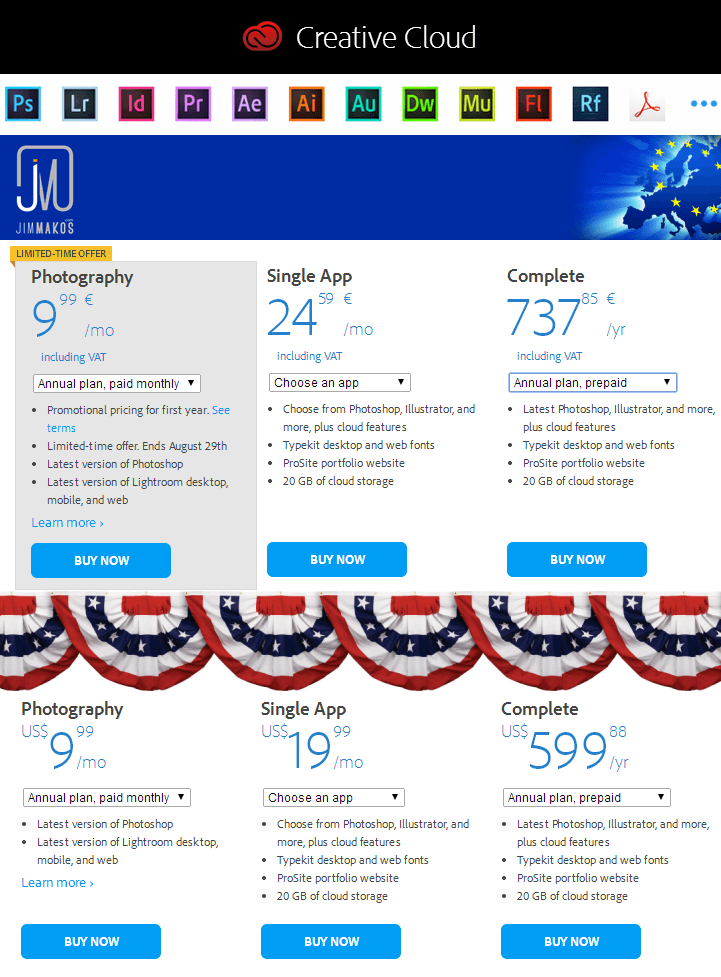

If you are based in Europe, the complete Creative Cloud plan will set you back 740 euros.

But if you switch to US dollars, the same plan comes down to $600! With the current EUR/USD rate at 1.31, that is equal to 455 Euros!

Go ahead and compare Adobe’s plans yourself from the comfort of your home. You can do so by selecting different currencies at the Adobe website.

Now, it’s one thing to confirm the price difference and another to actually order in the currency you’d like. That’s where your startup comes in.

How the US-based startup saves you money

Running a company for your business has a lot of advantages, one of which is separating your business expenses from your personal ones. Consider your startup a separate identity, both online and in the real world. Your startup can market your product, can sell your photographs, can promote your films.

Your startup can also buy online products and services, such as the Adobe’s Creative Cloud. And by being based in USA, your startup has several US bank accounts and US-issued credit cards, which can be charged online when buying goods for your startup’s needs.

Guess at what price your future US-based startup is going to buy an annual Creative Cloud plan, even if you are based in Europe.

Of course, running a business or a startup isn’t always bells and whistles. There’s an upfront cost for setting it up and accounting costs to mention a few setbacks. Yet, almost every day I keep running into benefits of having a US-based startup. Now if you’ll excuse me, I am about to save $400 and use Photoshop for editing my photos and Premier Pro for my upcoming videos.

PS: This post was originally published in my Medium account in August 2014. Hence, the difference in EUR/USD quote.

Photo via Flickr.