Oil Futures Trading: Did I Miss a 30% Move?

This is not investment advice. This video is made for entertainment.

I was considering investing in oil just yesterday. Oil price has been hovering around 20 dollars, the lowest price in the last 18 years. Analysts speak of a bear market that can push oil price further down to even 10 dollars. As I was willing to accept that risk, I was considering investing in oil with margin.

What’s margin trading?

It’s when I have a hundred dollars and I’m allowed to manage, say a thousand dollar position. That’s a 1 to 10 leverage. By doing so, any market move is multiplied by ten for my position, which means if oil dropped 10%, I would get a margin call as I would be 100% down! My broker would close my position since I would have lost my initial deposit.

I wasn’t going to trade with a 1:10 leverage, since the maximum allowed in the US futures market is 1 to 2. Here’s how I would do it.

Say I have 20,000 dollars to invest. At the moment I hold cash, gold and crypto. I was looking to turn some of my cash into oil futures. Specifically 10% of my investment capital. That means I was looking to risk 2 grand if oil dropped to $10. Thus, I would buy oil futures with that money using 1:2 leverage. If oil plummeted to $10, I would stand to lose 2 thousand. If oil climbed to $40, I would make 200%. That’s a 2:1 risk-reward ratio.

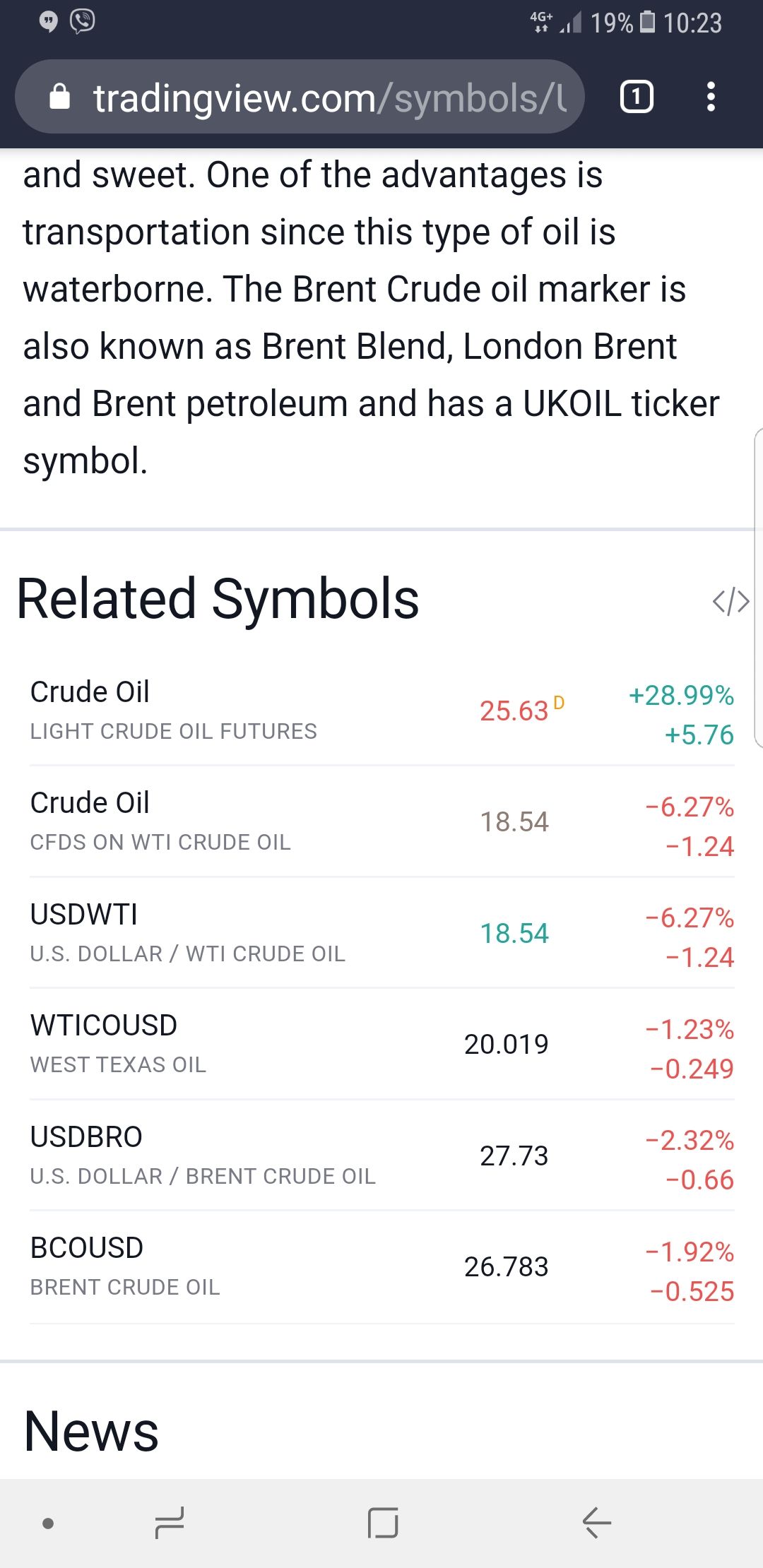

At the time of recording this, oil trades for $26. So, would have I made 30% overnight? No, that’s not the case. This is the futures rollover. Don’t get me started explaining what’s that about. Long story short, oil still trades below 20 bucks. Is it a buy or a sell?

Member discussion