We have defined our bankroll and staking plan we are going to apply and we may now calculate how much winnings we should expect and when we will make our first withdrawal. Because, after all, if we are not going to spend our hard earned money, what is the point to build our Betting System in the first place?

Yes, of course we would be proud of our achievement and we would gain extreme self-confidence, but it is the biggest satisfaction to know that you bought some goods with the profits of betting!

So, let’s see if the bank’s safe will be big enough to keep all our profits inside…

Once more we need to calculate some numbers, which will help us see where we are heading to and if it is worth the effort after all.

- The first thing to consider is the total turnover of our bets. This is easy to calculate by adding all the stakes (caution: for “lays” you need the liability).

- Then by deviding the total profits (or losses) with the turnover we calculate the yield (in case we are winning) of the betting system.

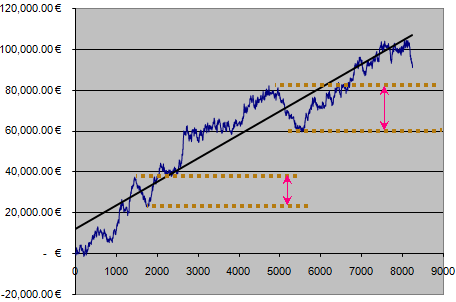

- Moving on, we fill a column in excel with the formula that adds the latest row’s outcome to the previous. In other words, starting from zero we add the wager’s outcome to the previous sum. In that way we can then draw a graph showing the progress of the betting system. Apart from having a nice drawing of the system’s performance, we are able to calculate the maximum drawdown of the bankroll. This is the biggest difference between a highest peak to a lowest. Here’s an example:

The drawdown is usually a number of bets (for a fixed stake of €500 the above maximum drawdown represents a loss of more than 40 bets) or a percentage of the bankroll.

These numbers can be calculated regardless of the staking plan.

Why do we need the above calculations?

- First of all, we need the drawdown in order to have AT LEAST that amount as bankroll, so that we survive a losing run. We will need more funds in order to keep betting, so I’d say the bankroll really needed is double the maximum drawdown.

- Turnover is in fact there just to calculate the yield but it is also a nice figure showing us how good of a customer we are to the betting company and perhaps calculate the commission we pay for our hobby.

- Yield tells us that for every euro/pound/dollar we bet, we earn that specific % of our wager in the long run, meaning by either winning or losing that particular bet we will make in fact THAT amount of money.

We now count the bets we place each month, calculate the turnover for that month and figure out how much money we stand to win during the next month. Jugding from the maximum drawdown we ALWAYS expect to hit a losing run of that size again and again. We examine the duration of the drawdown and we can see how long the next bad run will last. Finally, watching the graph we can evaluate if we may have a month or possibly two months without winnings or perhaps having a negative P&L.

All these are done so that we will be ready to confront a losing run, we know what to expect and know how big of a bankroll we should have available at one time. By doing all that, we can set a limit which when it will be hit, we withdraw the winnings above that limit.

Concerning the bankroll, the growth will be linear in case of flat betting plan (fixed stakes) but can be exponential if the kelly criterion is applied. For maximum growth a kelly fraction of “1” is necessary although it is not recommended as the risk is substantial. Remember, it must have been proven a winning strategy first (positive expectation, +EV, expected value) before applying the Kelly criterion, otherwise we will lose much faster.

Before moving to the last chapter of this series, I should mention that I have tried to show you how to build your betting system in the simplest way I could think of. There are a lot more sophisticated methods and the maths behind the whole project can be overwhelming. You may check some interesting links below for optimal betting, risk of ruin, bankroll growth, optimal bet size and formulæ (caution: a lot of maths included):

- Risk Formulæ for Proportional Betting by William Chin & Marc Ingenoso

- Simulation of the growth of a poker player’s bankroll (remember, all gambling related stuff have the same math concept, you always need winrate and standard deviation)

- Optimal Betting by Marvin L. French

- Risk of Ruin Index

- Drawdown mentality

- Kelly Value and Equity Curve of a trading system

- Fine-tuning your money management system

Ok, we have the betting system we needed and the profits have started coming in. You will notice that you will begin neglecting your spreadsheet and just submit your bets according to it, but won’t see that the spreadsheet will quickly become enormous and difficult to navigate through it. Worst of all you will find extremely difficult to fine-tune it for better results due to bad organization.

Your betting system needs periodic maintenance. We’ll talk about it tomorrow along with some last advice and many links to continue your studying…