My web publishing business is making 70% less revenue.

My personal income is down 80%.

And that’s after I laid off my freelancers and cut down every non-essential service my business needed to operate.

I could blame the Google Helpful Content update for turning my life upside down. But honestly, I am the one to blame.

And now I have to get out of the mess I’ve created for myself. I have to find a get-out-of-jail card. And as I’m doing everything I can to find that card, my cash runway will make sure I’ll survive the storm.

What is a cash runway?

The cash runway is how much time a startup company has before depleting its cash. But I am not a startup.

I’m a real person and online business owner, who saw his income almost evaporate in a month.

For me, the cash runway is the implied amount of time I have before solving the problem. Before making my company profitable enough, to sustain my livelihood again.

At this time I don’t have to dip my toes into our life savings. But unless I reverse the situation and recover my business, my wife’s income and my cash reserves are all we have to survive.

And at some point, they won’t be enough, unless we take action.

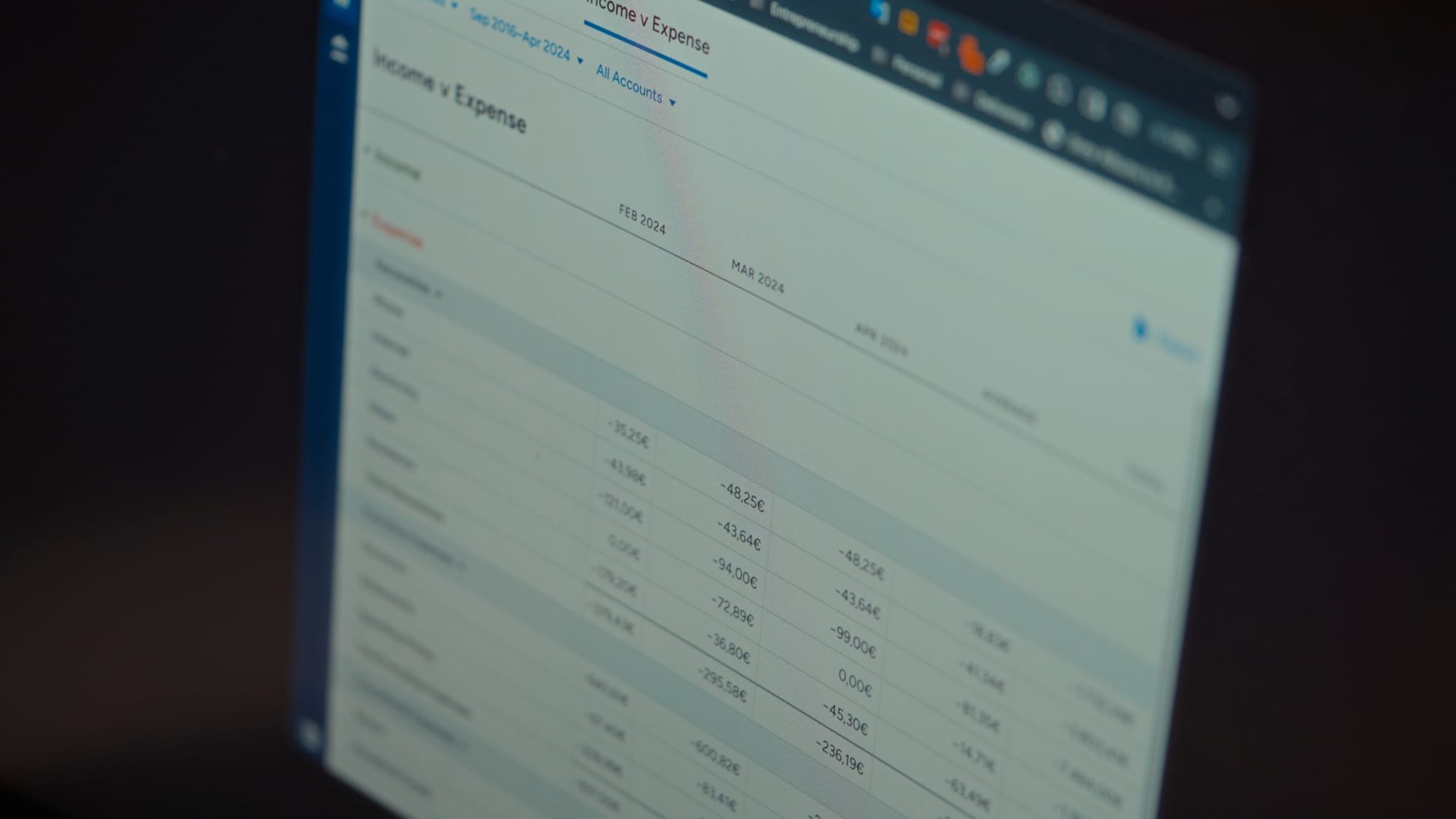

How I calculate our cash runway

Thanks to me budgeting for 8 whole years without missing a single day, I am able to calculate our cash runway down to the cent. That’s because I know exactly where we are spending money. And I also know what we can cut back during this emergency. Let’s throw some numbers now, to be fully transparent.

We have a mortgage that sets us back $400 every month. My wife’s income takes care of that.

Next, we have the essentials for our home. Electricity, heating, water and phone bills cost us $300 more each month.

Private medical care is another necessity, especially for me as an American business owner. The medical bill draws $200 from our bank accounts on a monthly basis.

Finally, in 2023 we spent $600 on groceries, $300 on restaurants and $220 on various things each month. That’s a total of $1,120 for eating and living comfortably.

Last year, additional monthly expenses have been $90 for clothing, $25 for banking fees, $120 for car insurance and taxes, $150 for housekeeping, $100 for car repairs, $60 for home maintenance and appliances and $240 for fuel and travel costs.

And let’s not forget school expenses for our daughter that came down to $650 every month. This includes private school, English and rhythmic classes, along with extra fees for school perks.

As a result, our way of living was costing us about $3,500 every month.

If our income dried up entirely and we had $35,000 saved up, our cash runway would have been ten months. I come to that number by dividing our savings by our average monthly spending.

Thankfully, there are a few steps to take to extend the cash runway.

How I extend our cash runway

First and foremost, we are bringing down our monthly costs.

Currently we do not have to budget for clothing and home maintenance.

We are no longer eating out. It’s been over a month since we went to a restaurant. We cut down on everything we can.

Yes, our quality of life will suffer, but the alternative is to end up hungry. Other people have it far worse and could end up even homeless.

Thankfully, we have my wife’s steady income. As a civil worker, the guaranteed monthly influx of money is hugely appreciated at challenging times like this. While it’s not close to my previous income, it is now thanks to my wife that we have a longer cash runway. Her income buys us time.

At the same time, my business still makes money.

I am still able to have SOME income. But I always plan for the worst case scenario. You see me working SO MUCH lately and be so vocal online because that’s how I operate.

I act as if I have zero income.

Losing what I once took for granted is a big motivational factor for me, although it doesn’t help my anxiety and stress.

So, we are minimizing our costs.

I no longer budget for school expenses. I asked my parents to pay for our transportation needs, that is our fuel bills, and take care of our daughter’s tuition next year, if I haven’t made it by then. Knowing that education is taken care of, lifts a big weight from my shoulders.

I’ve left the snooker club we made with friends, hoping that one day I’ll return and contribute once again. That cost me about $80 every month.

I now only do minimal car repairs. And we are not throwing a birthday party to our daughter for the first year since COVID hit.

Zoe wasn’t budgeting but she was able to save up some money from her salary. Now she needs to be even more frugal, but I expect her to keep spending at least $200 for her on a monthly basis. She has to eat at work!

So, from last year’s spending of $3,500, I’m bringing down the costs to $1,500 max. We must have medical care, an operational home and food. That’s the bare minimum.

We lived like kings, but now we have to make do with much less. While everyone can happily adapt going from lows to highs, it’s not easy to go from highs to lows.

Ok, now, I’ve taken care of minimizing our costs. For extending our cash runway I have to increase my income. And I need to do it as quickly as possible, so that I don’t reach the point where we have to withdraw from our life savings.

Increasing income is easier said than done.

I’m focused on recovering one of my websites from a Google update hit. This is my number one priority, as a partial recovery will probably double my current income which stands at $1,000 if I’m being optimistic. Making a thousand more will allow us to come out on the surface and take a breath, as I’m currently feeling like drowning.

However that scenario doesn’t look very likely at this moment. Projections look bleak, and while I’m still getting paid from revenues earned in January and February, summer will be very tough when traffic is always lower.

According to my predictions, and should the website’s decline doesn’t continue, my business will make just enough to cover its costs in July. Which means that by October I would receive no salary! And if the website loses all traffic, that will have tremendous consequences, since the company won’t be able to cover the website’s hosting bills, eliminating any hope for a recovery.

At least now, I stand a chance. And as long I have a chance, I’ll grab from everything I can.

They say time is money. But when you are looking at a cash runway, money is time. And right now, money buys me time. Time to make the revenue I lost. Time to avoid bankruptcy. Time to not go broke and time to bring my family’s quality of life back to normal.