European and US banks are collapsing. Fears of a bank run keep regulators on their toes, changing the rules of the game. The financial system struggles to fight inflation, despite massive layoffs. Are we heading to another financial crisis again, or has it started already?

Will the U.S. default or choose hyperinflation to solve the debt crisis?

A default sounds absurd. But even if it did, would that make a difference to you? Who cares if a country defaults on its debt? Or if we experience hyperinflation. Life goes on, doesn't it?

But how about watching your mortgage payment go up by 50%? How about selling your house for less than you bought it? Land never loses value, right?

What if you can't access your bank accounts? What if you cannot pay your employees or your partners?

What if you cannot withdraw more than $100 a day? What if I told you Greeks could withdraw only €60 per day in the summer of 2015?

As someone who survived the 10-year Greek debt crisis, I'm all too familiar with the word "default." And this time, I'm much better prepared to deal with a global financial crisis, yet again.

In this article, I explain what brought us here today. Also, I'm going through my plans of how to achieve a socio-economic jump that only a once-every-10-years crisis creates the ground for.

I lived to tell the tale of a default

For many months in 2010, everyone was speculating whether Greece would default on its debt and the implications that could have. People abroad couldn't care less, of course. It was only when they came across a Greek guy in real life and accused them of laziness.

"You Greeks live a life in the sun with our money!"

That's expected since, the furthest a problem is from you, the less you give a dime. You start caring only when a problem knocks on your door and affects your life.

But even if you ignored what was happening in my country, I bet you came across the ultimate and most devastating outcome this debt crisis could have: Grexit. And then the debate kicked in whether all South European countries would exit the Eurozone. The start of dismantling the European Union.

But that would go against the plan. So, despite a referendum urging the government to break ties with the Union, Greece remained in the Eurozone with a catch. Someone had to pay. The bondholders. Hold this thought.

Enter the United States.

US banks in turmoil

This week the world heard of a bank that very few had heard of outside of the States; the Silicon Valley Bank. The bank collapsed, and in order to avoid a bank run, the Fed announced that the bank's savings were safe, even those that weren't insured by the FDIC (meaning deposits over $250,000).

Shortly afterward, a couple more banks entered the mix, Signature and First Republic banks. In an unprecedented move, eleven banks came to the rescue and saved the latter, while at the time of writing these lines, the Signature bank was up for sale.

So, the problem seems to lie on the other side of the Atlantic. Or does it?

Enter Credit Swiss.

Big European bank in Crisis

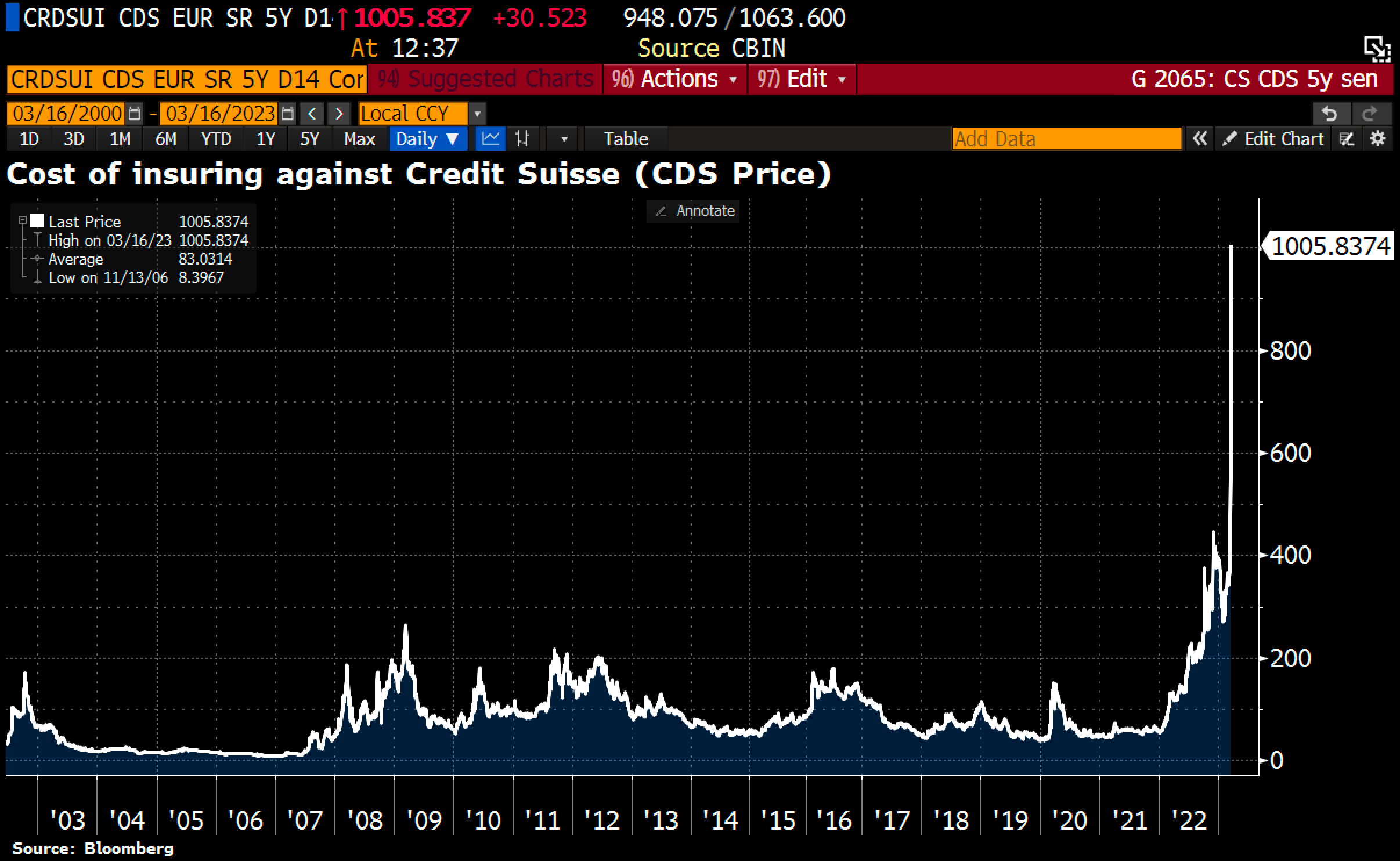

Swiss Bank, Switzerland's central bank (like Europe's ECB and USA's Federal Reserve Bank - Fed in short), offered a lifeline and agreed to loan the bank about $50 billion, as the bank's CDS were skyrocketing, signaling an imminent default.

While the American banks mentioned above were regional, Europe is dealing with a Too-Big-To-Fail bank. Credit Swiss' assets are worth hundreds of billions more than SVB's. Besides, SVB was used by startups and businesses, while Credit Swiss is an investment bank. And speaking of investments, those don't look so good.

But what causes the banks to collapse in the first place?

How a bank runs out of money?

And who's getting to pay the bill?

What is triggering the banking crisis?

To answer these questions, we need to go back. We need to remind ourselves that we are still in a pandemic. We need to remember when the world changed.

Enter COVID-19.

Yes, that virus we kept hearing about in 2020 and its daily death count until vaccines rolled out a year later. The world had decades to experience a worldwide health crisis in such proportions. And a health crisis of such scale will lead to a financial crisis sooner than later. Disagree?

As individuals, we value health more than wealth. That's a basic instinct.

When we're sick, we don't go to work. We couldn't care less about making more money when we lie in bed in pain. Priorities shift immediately, as our health deteriorates. Suddenly, everything is pointless until we get better.

In 2020 the entire human race was sick. Therefore, we used every resource to make us healthy again. Like an individual who would sell everything to get better and avoid death, the whole planet sacrificed everything to find the cure.

Businesses were forced to close down, and people were forced to stay at home. Work came to a halt. The human race was in bed and needed to survive.

But while in survival mode and confined, people still needed to eat. Their home still needed heat and water. And as our communication was restricted to electronic devices and the internet, energy was very much a necessity.

But since very few humans were at work, who was going to pay to provide all that?

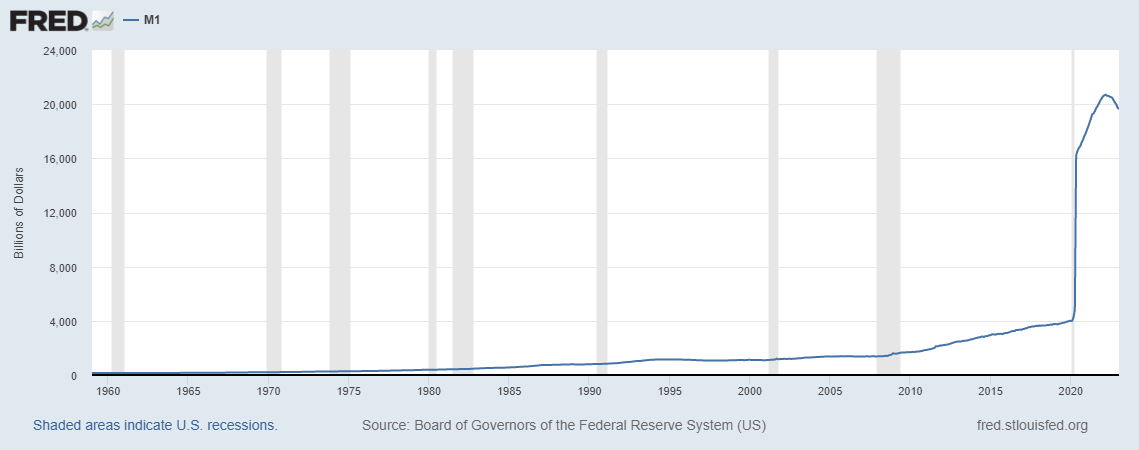

Money began falling from the sky. Helicopter money. Central banks began printing money. Fed's money supply skyrocketed, and ECB quantitative easing accelerated, both of which meant creating money out of thin air.

Money kept coming in for people staying at home and business owners who had closed their businesses down.

The money supply was bigger than the demand. We didn't need that much money. We didn't go out. We had nowhere to spend that money. We didn't travel, airplanes didn't fly, and we didn't commute.

When people can't spend money, they unavoidably begin saving money! Which leads to deflation. Money was gaining value! Cash was king.

So, central banks' interest rates were close to zero. In Europe, interest rates were negative! You were paying money to the bank to store your cash!

A bank run was unheard of during the first two years of COVID-19. Since the government was pouring money into the market and people had minimum expenses stuck at home, money was accumulating in the banks' savings accounts.

So, the banks seeing all that money piling up in their accounts, looked for ways to make some additional profit.

Enter the bond market.

Banks: Let's make easy money from bonds!

The world had come to a stall. Companies like Boeing didn't fly their airplanes. Inevitably, the stock market was crashing. At the pandemic's start, we couldn't tell when life would return to normal, so companies began earning money again. With earnings projections looking bleak, money was leaving the stock market.

Except for banks. They had all the money in the world. At the same time, Internet startups were running fund rounds at an alarming rate. COVID accelerated the web startup ecosystem, creating huge value for new ideas.

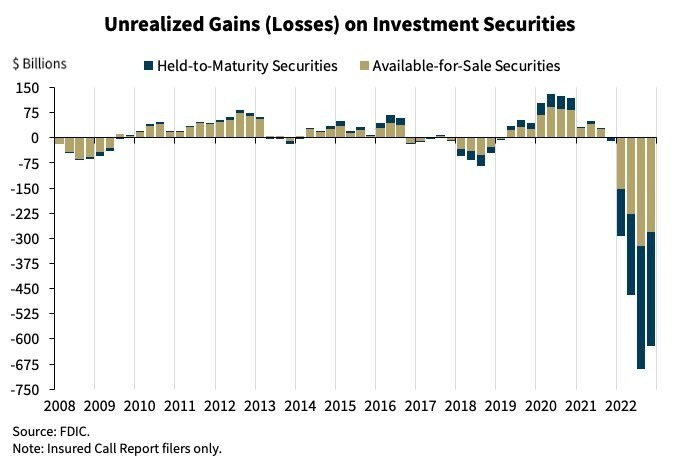

All those businesses deposited those funds in the banks. Sharks die when they don't move. Banks had to move that money to make more profit. So they turned to the bond market.

As the central banks' chiefs were sure the interest rates would remain very low for years, government bonds' 1.5% rate began looking attractive to the bankers. Based on the big boss' words, why not make an extra 1.5% for the next ten years?

Note: that was what led retail investors to buy Greek bonds in 2010 since every public figure declared Greece was financially safe.

Thus, banks bought hundreds of billions of dollars worth of bonds with depositors' and investors' money. People wouldn't need to withdraw their money; we get to make a few bucks while the money sits still or change hands within our bank.

But the human race was getting better.

Life is back to normal; hello, inflation

Humans began vaccinating. Life gradually got back to semi-normal. Businesses were allowed to open up again. People, hesitantly at first, began going out wearing masks. They kept a safe distance and tried to enjoy the little things in life they had missed at first.

Then, new variants of the virus proved to be less lethal. Eventually, only a few humans haven't got sick from the virus today. People began living with the virus who isn't as threatening as before. Masks were dropped, and precautions were lifted. Life got back to normal.

But now, people, confined in their apartments for months on end, are eager to travel, eager to eat out, eager to enjoy life to the fullest.

Unsurprisingly, people are eager to spend.

Eager to spend all that money they had saved up while restrained at their home.

Now, people don't want their money. They give it away for stuff, for experiencing life. They value that more than before.

So, money loses value. When you give something or sell something, you signal it's worth less to you. Hence, inflation!

But the central banks' chairmen are sure. They have stopped printing money and declare inflation is just transitory. We'll tackle that with a few rate hikes and call it a day.

This signals to the banks that bond rates won't increase much. So their bets in the bond market should be safe.

But central banks are struggling to control inflation. Transportation costs and raw materials prices are doubling up or more. Oil price shoots above $100, and the increasing price of natural gas in Europe leads governments to rescue people who can't afford to heat up their homes.

Everyone keeps spending no matter the cost. Groceries and eating out cost 20-30% more at the very least.

What do central banks do now?

Of course, increase rates!

Implications of raising interest rates

The Fed sends interest rates to more than 4%. The ECB follows up with rate hikes, 0.5% up every other month. Mortgage rates begin taking a toll on homeowners. As business loans start becoming expensive, businesses need to keep their costs low.

Thus, layoffs.

But unemployment is still at 3% in the USA. It must go to 5% for monetary policy to pause its hikes. At the same time, newly unemployed people get three-month severance pay. That buys them a runway till summer. Thus spending doesn't seem to pause until then.

And for inflation to stop increasing, people need to stop spending.

Let's summarize (tl;dr):

- COVID-19 restraints end, so

- People go out and spend, so

- Inflation is up, so

- Central banks increase interest rates, so that

- Businesses lay off to cut their costs, so

- People cut their spending (recession), so

- Inflation is down, so

- Central banks decrease interest rates

That's the playbook of the central banks. But increasing interest rates has collateral damage and comes at some costs. One of which is the regional and investment banks holding older bonds at lower rates for ten more years!

Were the banks played by Central Banks?

One could claim that. The central bank's chairman is the one who shares the guidance for next year and also the one who decides to follow that guidance. So, announcing that we'll experience just transitory inflation but then hike interest rates because, what do you know, inflation keeps ramping up, and this is the only way to control it, does make banks who invested in bonds seem less guilty.

In my previous letter, I explained how the rates affect the banks to the point of collapsing.

Now, how much more can they afford to increase the interest rates? The more they increase them, the more banks face bankruptcy. So, as long as the rates are at this level, many banks are already experiencing losses. Increasing them more, even 0,25%, could make more banks insolvent as losses pile up.

At the same time, they can't just begin dropping the interest rates, as that will send a very bad signal to the market, sacrificing a few banks just before shifting gears.

So, time is running out for the Central Banks. And they are left with two choices.

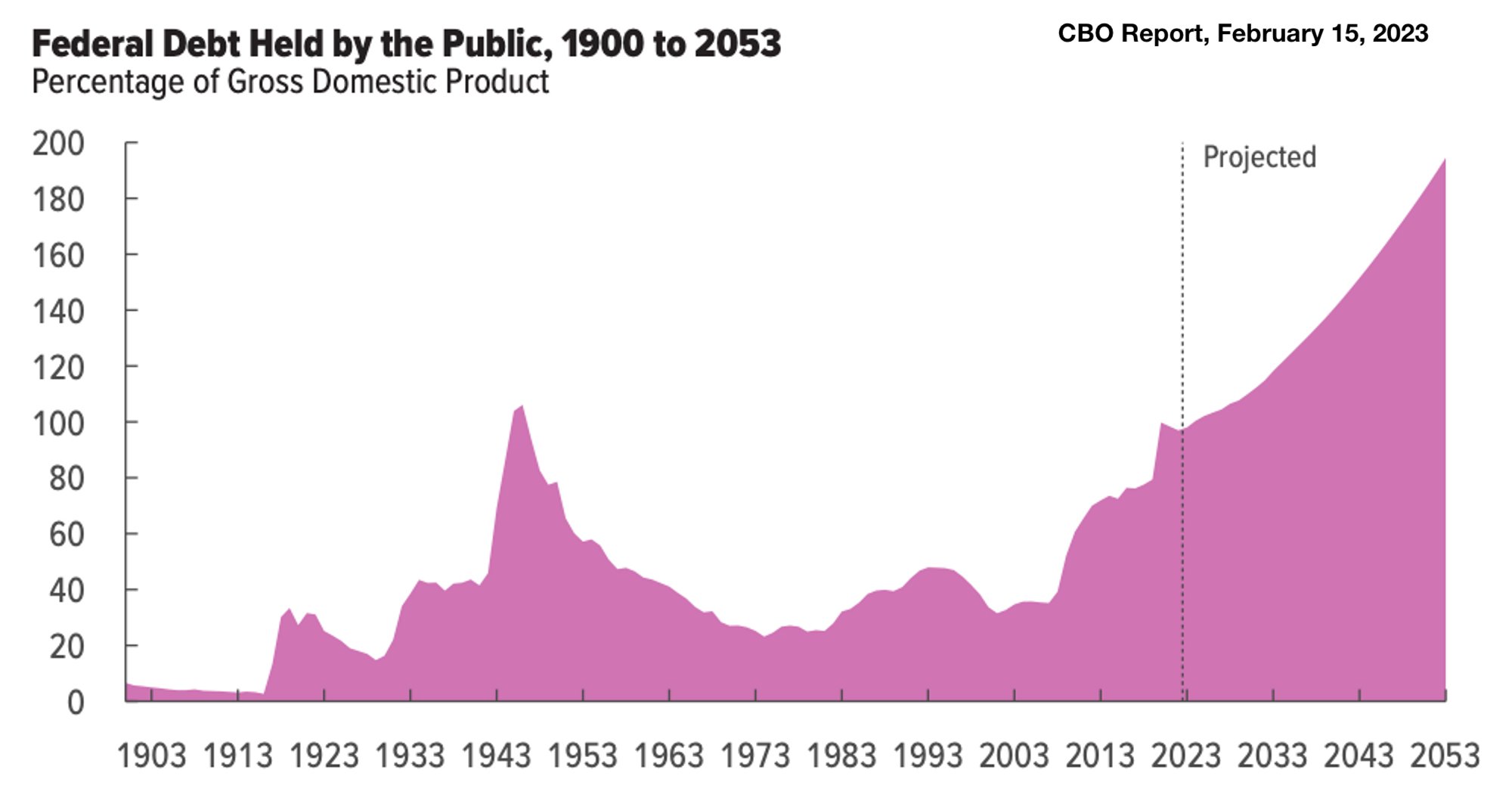

Print money again or default

Of course, they'll start the printing machine again and keep buying the debt for as long as possible. Hello, hyperinflation.

The alternative is a default in Greek style. See how all that plays together?

You see, Greece couldn't print money on its own.

They were asking for bailouts from the EU; in effect, they were asking for printing money to buy our debt. Eventually, Greece wasn't a Too-Big-To-Fail country, and the big bosses decided to let the country default. During such a default, debt disappears by hurting investors first. They are the first in line and the depositors last.

Hence, bond haircuts.

Instead of finding or creating money to keep the debt rolling to other hands, they cut the bond's value. Bondholders, who had invested $100,000 in 10-year bonds at 5% found their bonds now worth $60,000. They had bought $100,000 worth of debt, in exchange for 5% yearly returns. But due to the haircut, they are now holding $60,000 worth of debt. That $40,000 difference is what allowed Greece to continue doing business.

Note: those bonds' maturity dates also moved 30 years in the future! They won't take their money before 2042!

In the case of the U.S., a default sounds impossible. But that's what people said for Greece at some point.

Only the U.S. is a Too-Big-To-Fail country.

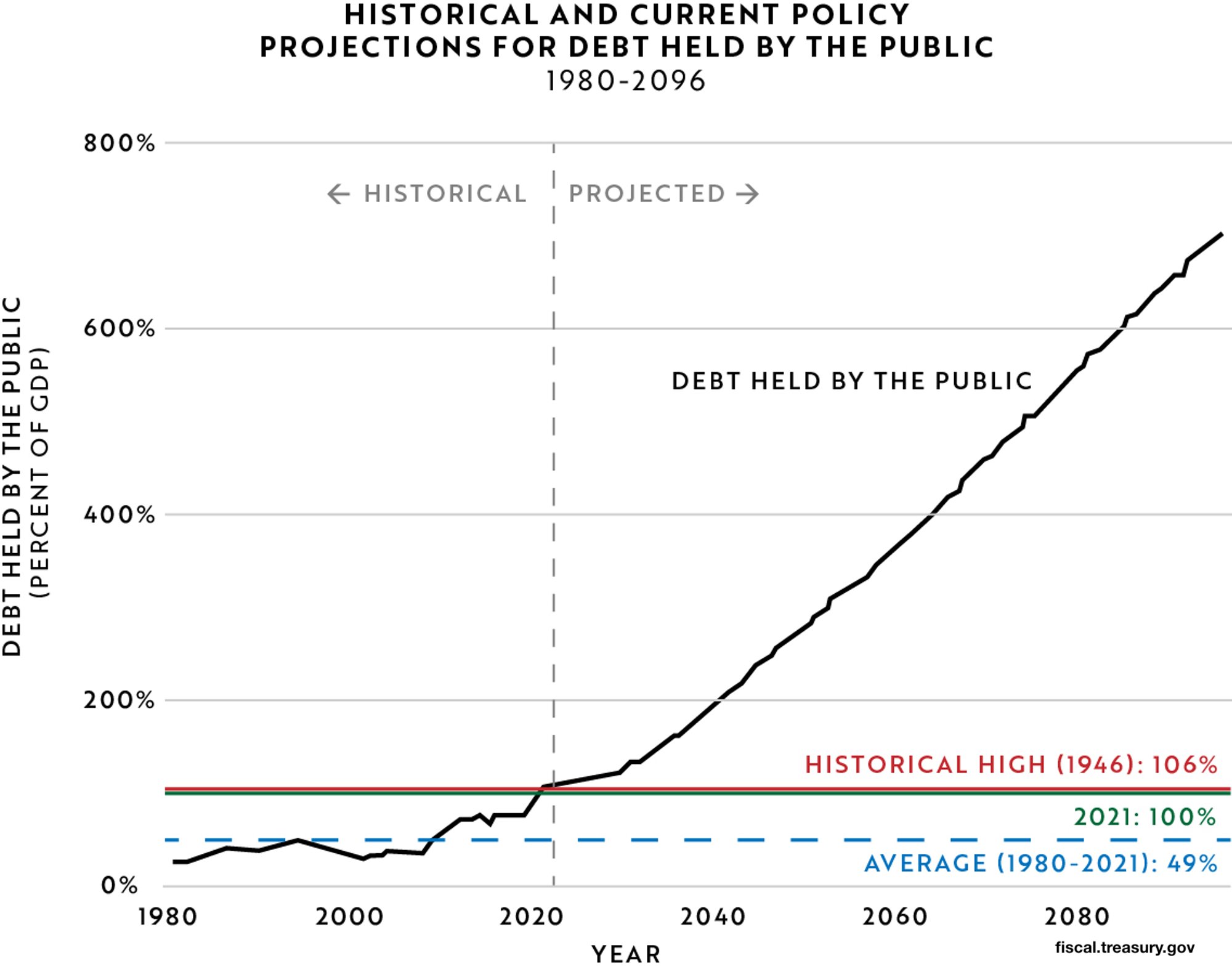

Hello, United States debt crisis

What do we do?

Having said all that, what can we, as individuals, do at times like this? How can we ride the storm and survive yet another financial crisis, which some of us are all too familiar with?

This is what I'm doing:

- I'm not keeping a deposit amount in any bank more than the insured threshold. That's $250,000 in the US and €100,000 in Europe. If your business needs more than that, split the amount to more than one bank. Also, avoid smaller banks. We witnessed the discrimination between regional and big banks. When I incorporated my business in the US in 2012, I had two choices: Citi and Wells Fargo. Ten years later, these two remain one of the four big US banks, so I'm staying put. The same applies to non-business cash that can also be stored in crypto.

- I'm saving as much money as I can. We all did that in 2020 during the Covid-19 peak time. But how many keep doing that nowadays?

- I'm trying to make as much money as I can. You can save that much. But the sky's the limit when making money. So, my main focus is on my web business which I try to grow every year.

- I'm avoiding lifestyle inflation. It's easy to begin spending more the more you're making and indulge yourself in a more luxurious lifestyle. Stay humble, or the market will humble you.

- I've paused my investing. Crypto is the only asset I may invest in from time to time. Once $hit hits the fan, and everyone is scared to buy anything, investing in stocks and real estate will look promising again. Until then, cash accumulation is key (I've heard people are investing in gold and silver, though.)

- Find the joy in life. Life isn't about banks, monetary policies, and rate hikes (ok, for some dragging golden balls may be). Happiness lies in simple things. The difficult part is finding what makes us happy. But to find that, we need to be healthy and wealthy. So I'm taking care of my health, keep building my wealth and enjoying the little moments that fill me with joy.

During yet another debt crisis, save yourself. The reward will be big, much like the rewards for anyone surviving the 2007 global financial crisis. By the way, you do remember where that crisis came from, don't you?