Once you start making money, the general advice is to try and save money for building an emergency fund. That should be the number one goal in your personal finance strategy right from the start. And this month, I hit that milestone.

Contrary to popular belief, I am not set for life. Far from it actually. Yet, people get that idea when they read on my blog that I used to trade millions on betting exchanges and made thousands of dollars on poker tables. While that’s true, no one remembers my posts where I lost money or when I ran a hundred thousand dollars below EV due to variance! And very few people even know how much my attempt to trade in Wall Street and forex cost me.

So, it may come as a surprise to hear that I haven’t even built an emergency fund myself all these years. While I was trying to make as much money as possible, I was ignorant of personal finance basics. Although I was always mindful of my finances, I spent way too much money on things I didn’t really need, whereas I should invest that money and not sacrifice my financial freedom. That changed a while ago, and this month I’m completing my first task to build an emergency fund.

What is an Emergency Fund?

An emergency fund is a sum of money that covers my living expenses. I need power, water and internet for my home, something to eat and some money to spend. By tracking my spending for years, I know that I need 200 euros for my house to operate smoothly and 900 for food and necessities. That’s the bare minimum to keep my current lifestyle. I’m rounding this up at 1K per month since I expect I won’t be dining out at restaurants that much when I won’t have an income. So I have now accumulated 12K in my emergency fund that can last me for a year if shit hits the fan.

There are a bunch of other expenses, like school tuition, car insurance, and clothing, but those can be eliminated in a worst-case scenario. If things go really downhill, paying for a private school, driving a car, and buying new shoes won’t make much sense. The aim will be simply to survive, while I’ll have twelve months to figure out how to start making money again. It will already be a very stressful time, so cutting the funding from twelve to nine months just for maintaining a luxury car would be pointless. And yes, education is a priority, but health and surviving financially is a bigger priority. What’s the point of paying for private schooling if we run out of food in a year?

Where do I stack the emergency fund?

Usually, that sits in a bank account for immediate access. However, given the connected world, we all live in nowadays, I’m opting for a slightly different approach. Note that from now on I’ll be referring to the emergency money in terms of how many months they can help me survive. I bet this will help you draw a better picture and make adjustments for your own emergency fund easier.

First of all, two-months worth of funds are in cash. Maybe all of my online accounts are hacked, and I have no access to a bank. I believe two months will be enough for me to figure out how to get hold of my digital wallets. That cash will make sure I’ll survive for that long.

Next, money in bank savings accounts will last me for five more months. I’m opting for a savings account compared to a current one since the interest rate is a tiny bit higher. Also, the savings accounts have no withdrawal penalty, which is typical for long-term savings deposits. Thus, I can have access to that money on the same day.

The remaining funds that will help me survive the last 5 months of unemployment are allocated to gold and crypto. Wait, wait, hear me out. Yes, that’s part of my investing capital. In fact, I do include those funds in my off-budget part of my spending tracking software, whereas I should have them in my actual budget. It’s money covering living expenses, after all, right? Why do I elect to invest part of my emergency fund, which is strongly recommended against by personal finance experts? Let me explain why.

Investing part of my Emergency Fund

I am using a bunch of digital wallets online. One of those is Revolut, which allows you to turn some of your money into cryptocurrencies with the press of a button. That convenience comes at a cost since they charge a 3% commission for a round-trip transaction, whereas the standard commission of a cryptocurrency broker runs at around ten times less than that. However, I can convert those bitcoins back into euros just as quickly. Hence, I consider that money as easily accessed as my digital cash. That’s why I include it in my emergency fund. I can get hold of that money in cash the day after tomorrow at the worst-case scenario. Should I run out of cash and money in my bank account, the next step would be to use that crypto.

Note at this point that I am not buying actual crypto coins via Revolut, though. I’m merely speculating on their price.

I hold actual Bitcoins, well, part of a Bitcoin, in cryptocurrency accounts in Kraken and Bitfinex. In case I ever need to turn those back into fiat money, I expect it to be a longer process, but probably will take no more than a week or so.

Finally, my gold is held in my brokerage account, used for buying stocks, forex, or futures. Selling that gold for cash will be my last resort when all other accounts would have been depleted. So, gold will be used for the last two months of my survival, and then I’ll hold no more investments, which I shouldn’t in the first place, given I didn’t have an emergency fund!

I understand that crypto and gold prices will fluctuate, affecting the emergency fund’s total worth. Still, the biggest part of the emergency fund is in cash. The riskiest part of the fund is holding money in cryptocurrency, which has a small chance of going down to zero. Should that happen, I will need to replenish my fund with 3-months worth of money. As long as the downturn hasn’t yet happened by then, it won’t take me more than six months of work to save that money, living extremely frugally.

Summing up, my emergency fund consists of 2 months’ worth of money in cash form, five months in bank deposits, three months in bitcoin, and two months in gold. From now on, every cent I save will mostly go into growing my online business and occasionally adding to my investing capital here and there. They say you have to have a million before investing makes sense. However, as long as I don’t need that money for my business, I hate to see it sitting idle.

Building an Emergency Fund for a Company

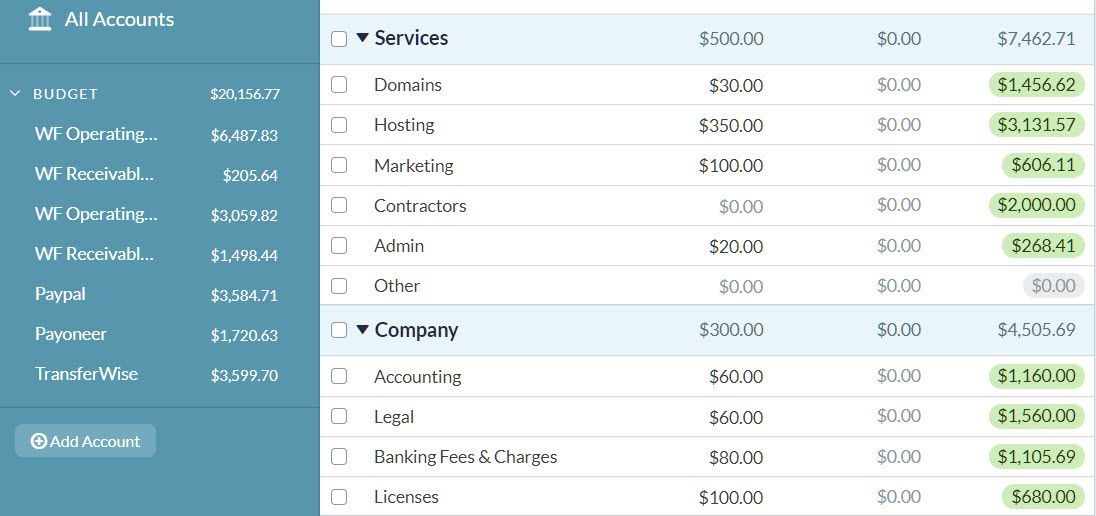

Speaking of my business, I have taken a similar approach to run my company’s finances much earlier. My web publishing company, incorporated in the USA, needs $300 per month on average to operate as a company. That includes accounting, legal and licensing costs. Then it needs $500 more for adequately running the websites. That includes web hosting, domain management, marketing, and administration fees.

In conclusion, I need $800 per month for the company and its websites to continue operating smoothly. So, by having $10K at least set-aside, I can survive 12 months with no sales and revenue. No need to go down the loan road.

And speaking of loans, my company and I are debt-free, which makes a huge difference mentally and financially. Well, except for our home mortgage. But that’s a story for another episode. I’ve heard though, that people are borrowing money to buy… cars!

Avoid spending money early on

These depreciating assets are, by far, my worst spending traits. I got the first one 15 years ago because I wanted to reward myself for making money by myself when I should have rewarded myself by investing that money. Those 50 thousand euros would be worth more than 100K now, assuming a 7% annual growth. That’s eight emergency funds right there! At least, I didn’t go into debt to buy that car.

I got the second one as a family car, and on the greatest deal ever, as government halved import taxes during that period as an incentive to boost car sales, the dealership offered a 20% discount on top of that, and I even split the cost with my father! I spend 30K on a car worth triple that money, so I haven’t got that many regrets about that car. And besides, I would have needed a family car at some point. Raising a family of three in a roadster would be impossible. That family car was also bought with cash that could have been used much better in my thirties.

Building an Emergency Fund Late in the Game

So, at forty-one, I finally took action on my personal finance and funded my emergency fund. I should have done that at my 25 when I was earning as much as an emergency fund every month. But the internet wasn’t anything like it is today. Knowledge was scattered, and Google and YouTube were just getting started. I never heard of personal finance for the next ten years, while I was trying to make a living online. First I needed money, then I needed someone to tell me what to do with it! So, I focused on that. On making money that is! If only I had come across personal finance even by accident. I would stand a much better chance of achieving financial independence now. If you are a lot younger than me, educate yourself for free online. Don’t make the same mistake and neglect the power you are holding in your hands right now.

Yes, apparently, I talk about money a lot online. That has always been my niche. Money won’t buy you happiness, but it will buy you freedom. And I have yet to see a free person, a truly free person, who is unhappy. Stay healthy and wealthy.