I went full-time forex trading this week. I was glued to the screen 5 days straight and traded from the moment I woke up to the time I went to bed. During the necessary breaks for lunch, gym, family and bathroom, I stay connected with the forex market via my smartphone, modifying and executing orders. And these are the 4 lessons I learnt by doing all that.

A forex newbie?

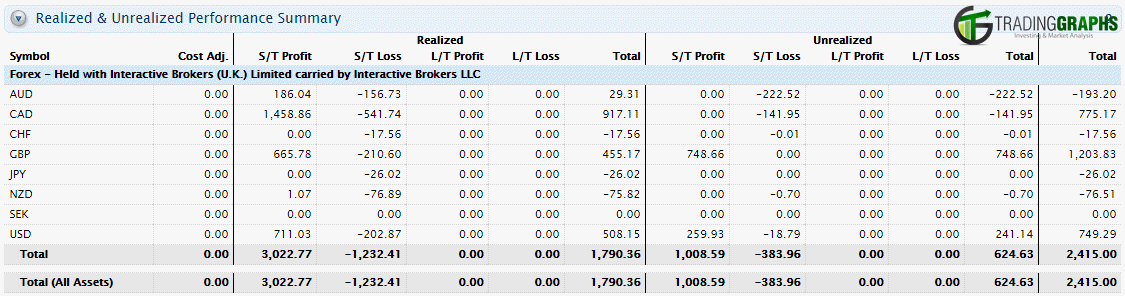

Not by a longshot. The first time I demo’ed forex trading, it was back when Refco was considered one of the most popular forex brokers. For many of you the name might not ring a bell, as the company went bankrupt shortly afterwards in one of the first shocks in modern retail forex times. Since then and for the last 5 or so years, I have been trading forex at Interactive Brokers. So, no, I am not a newbie in forex trading, yet it was the first time I took it so seriously as to become a full-time forex trader for a whole week.

And it surely was both fun and exhausting. Both mentally and physically. But it had some good days.

Lesson 1: Don’t trade in tiny timeframes

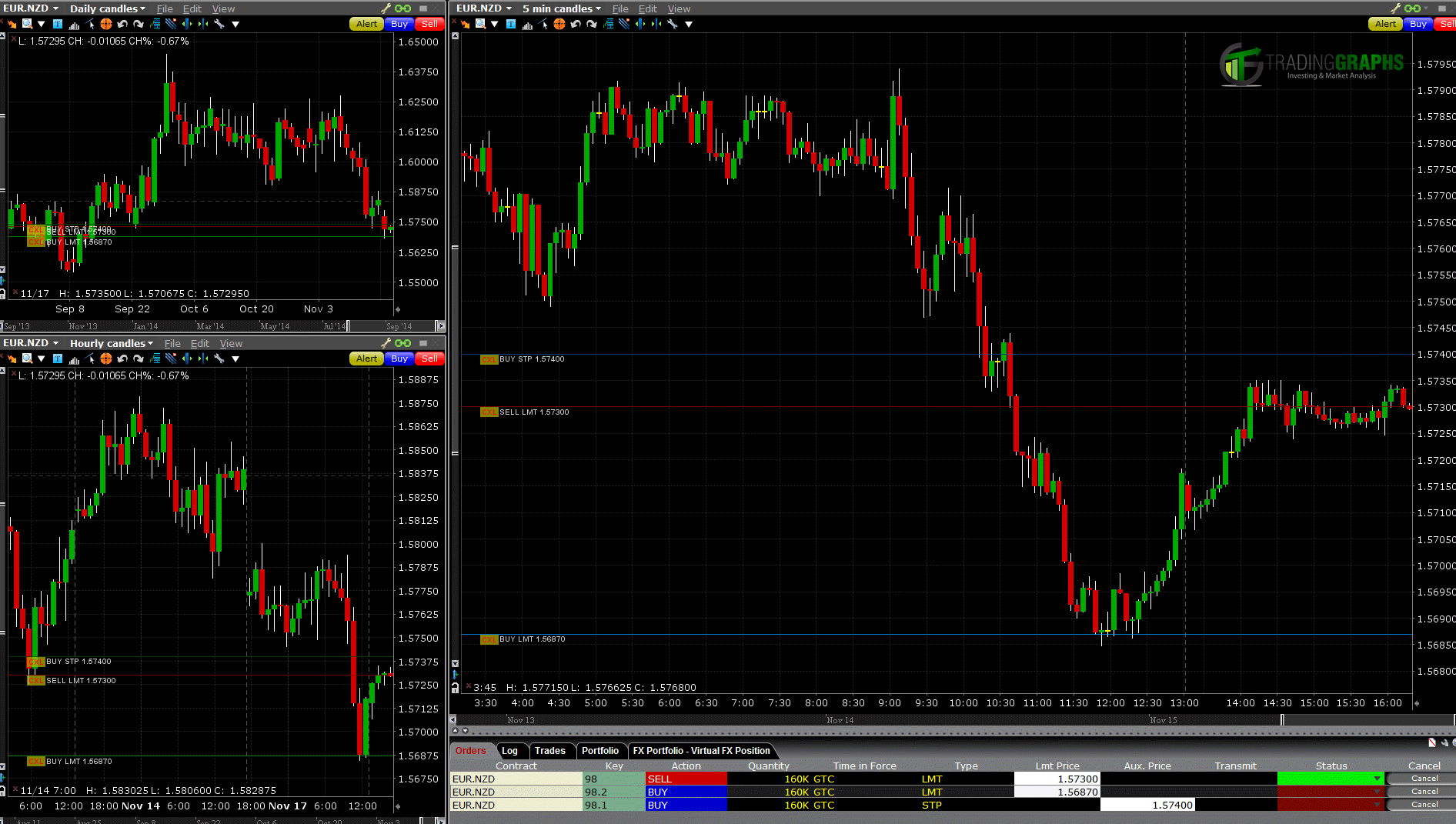

Let me start by giving you a brief layout of my trading setup. Here’s a screen grab as I was shorting EUR/NZD.

I use 3 charts: the daily, the hourly and a fast one, usually the 5-min or the 3-min chart. Occasionally I will go even faster, down to 1-min chart, but that is an exception. I start with a glance to the daily chart to catch up with the long-term trend, move down to the hourly chart to pinpoint support and resistance levels via trendlines and pivot points and then use the third chart to pick my entry point. For the most part, my entries are limit orders, waiting for the market to pull back or expecting a likely reversal after an established trend.

And then comes the news. Forex news range from insignificant to VERY significant. Depending on the importance of the news, currency pairs may react violently or not at all. When it is the former, the market goes haywire.

It was one of those occasions (the violent one) that made me lose a day’s profit, due to overtrading. Since the 5-min chart was unusable printing big red and green candlesticks with long tails, I switched down to 1-min chart. Long story short, I found myself trading at 10-sec charts!

For many traders, those charts are full of noise. You cannot make predictions because of the noise, that is price action that does not seemingly follow a pattern.

Yet, when hot news hit the market, trends do develop even at those timeframes. The problem is you’ve forgotten the big picture, aka the 5-min chart or the hourly chart. Things happened so fast, that I traded way too much, changing direction in seconds’ time. It was only when I stepped off the gas and went back to the 3-min chart, that I realised I have been trading in the middle of a chaos. Should I have stayed on a slower pace, there were some obvious support and resistance levels that I could easily pick some money from. Instead, I elected to trade in-between those key levels, as the market struggled to find direction and bulls were fighting bears.

So, I will never go to multi-second charts again, even when my broker offers them. The 3-min chart is just fine if I want to trade a lot and quick.

Continue reading at TradingGraphs.com