Personal finance is a buzzword that gets thrown around a lot lately.

But as a kid, no one told me anything about it. I ended up in the rat race as a work-from-home guy instead of being financially free now, despite the money I made.

All they had to do was tell me this.

Make more, spend less, retire early

That's it. That's all I should practice in my twenties.

And although I did make more, the fact that I'm not retired now tells the whole story.

- I didn't make enough

- I didn't cut my spending

Understanding personal finance was easy once I broke it down into small, manageable steps. The way it works for me is in this order:

Savings: First step to financial freedom

It's easy for me to preach about savings as a grown-up dad. But I doubt I could convince even my younger self to save money instead of spending it on a sports car.

Because, that's what I did with the first real money I earned.

I got a sports car. 🤦♂️

If I had invested the money instead, I'd be halfway to retirement twenty years later—just from a sports car! 🤯

Sure, I wouldn't get to drive a fancy car in my twenties. But in my forties, I might not have to work at all! How valuable is that?

- Drive a sports car and work till your seventies

- Keep your old car and retire by your forties

If only someone told me that. So, I'm telling you this now. Replace "sports car" with any big expense and decide for yourself the sacrifice you're making.

Budgeting: How I know how much money I'll need NEXT year

At some point, I'll be known as the budgeting guy.

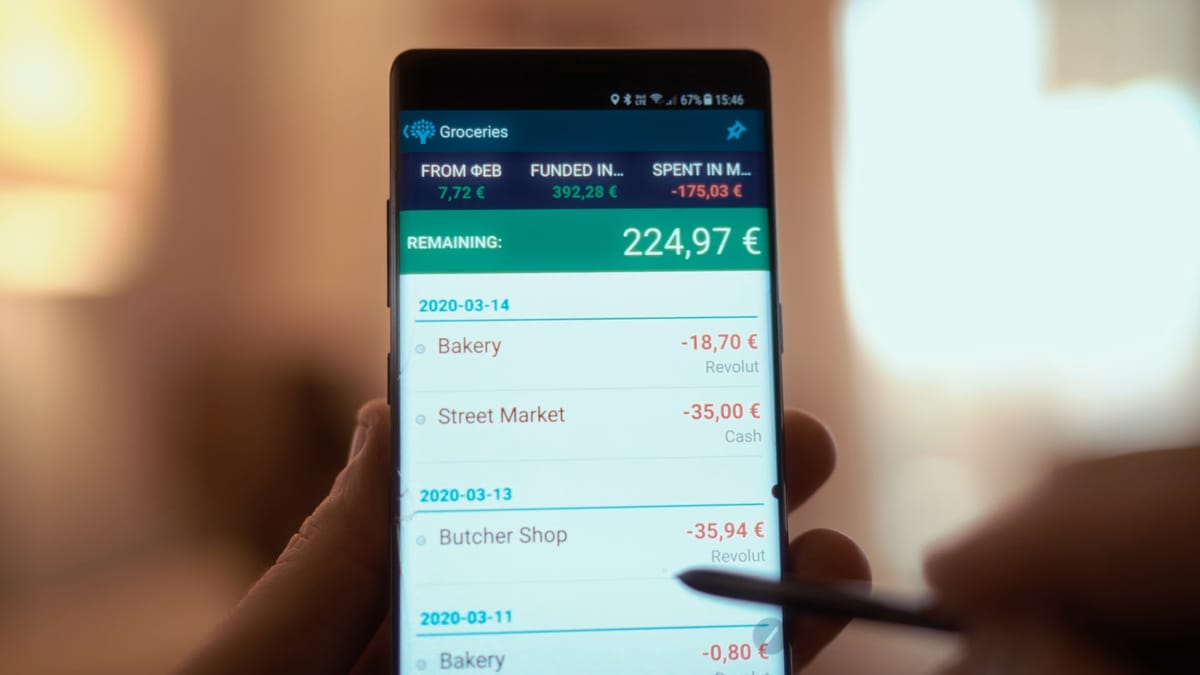

I really feel that way after tracking my finances and keeping a budget for my family and my business for more than ten years! Without skipping a day or a single dime leaving my wallet.

Discipline is my middle name. And numbers are my thing.

Ever since I downloaded a budgeting app, I was hooked. Too bad it happened in my mid-thirties. I wouldn't have bought that sports car!

Now, I want to convince everyone to keep a budget for themselves. I can't stress enough how beneficial budgeting has been in my business and personal life.

Investing: Making money work for me

I used to think that investing is looking at a screen for 8 hours.

Nope. That's a day job. And I used to do it when I was involved in gambling.

As I was discovering personal finance ins and outs, I realized that investing is a slow, relaxed process.

Once I had my savings and knew how much money I'd need the following month(s) and year(s) thanks to budgeting, I now KNOW how much money I can invest.

How to invest is quite easy, in fact. The hard part is knowing how much to invest, and you cover this in the two previous steps.

Do you see why the order is important?

Retirement Planning: Buying time to live free

This is the final level if personal finance were a video game. We get to beat the big boss here, and the rewards outweigh all the sports cars we could buy.

No more commute, no more meetings, no more phone calls.

No more stress.

That's what savings, budgeting, and investing buy you in the end. We call this "retirement".

Savings, budgeting, and investing ultimately buy you that.

But the journey can be fun, much like playing a video game. So, are you ready, player two?