Greek online poker players are liable to pay up to 20% withholding tax at Pokerstars on their daily profits, starting today. The breaking news came yesterday night through an email sent by Pokerstars and FullTilt Poker to their Greek customers.

According to the email and the FAQ page that Pokerstars published for this matter, Greek players will now access Pokerstars poker client through the new domain, pokerstars.gr. Along with fulltilt.gr, these two domains are now legally operating in Greece, after Pokerstars partnered with Diamond Link Ltd to jointly operate the domains under the necessary Greek gambling license.

Diamond Link is one of the 24 companies that hold an interim gambling license in Greece – read more about the new Greek online gambling regulations. Still, I wouldn’t be surprised if the licenses are revoked in the future, given they were issued temporarily until the new gambling regime would be settled. Something that is still work in progress after 2 years, since the legislation’s introduction!

Why Greek players are subject to online poker tax

The first and most crucial consequence for Greek players is the players’ withholding online poker tax. According to the Greek gambling law applied to sports betting, poker and casino games, gambling profits exceeding €100 are subject to tax. For example, if Greeks bet €0.30 on a sports event (the minimum accepted bet) and win €400, they are liable to pay 15% tax, or €45. The tax increases to 20% for any gambling profits that exceed €500.

Yet, there has been quite a debate about how to calculate poker profits and subsequently, how to tax online poker games. Till yesterday a player’s poker session was defined as the time between logging in and out of the poker client. In other words, how much time a player spent logged in.

Pokerstars clarified in their FAQ page that the withholding tax will be charged per calendar day, starting at 7AM local time.

Thus, a poker player residing in Greece who plays for 3 hours on Monday evening and wins €500, will be taxed €60. Pokerstars will automatically deduct the tax from the player’s funds on Tuesday morning. Say the same player wins again on Tuesday about €1,000. The tax now comes down to €160!

As a result, their gross profit would be €1,500 but their net profit would be €1,280 after tax!

Let’s assume now that they lose €1,300 on Wednesday. They would still have been profitable before tax, but due to the recent changes, they are now almost a breakeven player! Over at twoplustwo forum, players are worried that the tax effectively amounts to 40% of all poker winnings!

Although this tax is imposed on poker players directly, any kind of tax imposed on the online poker industry will hurt your winrate one way or another.

No major online poker tournaments for Greeks!

But there’s more unfortunate news for Greek online poker. Since November 20, Greek Pokerstars players noticed they couldn’t register to major tournaments, like the popular MicroMillions. It turned out that Pokerstars had already decided to restrict access to those tournaments, which was confirmed yesterday night. In effect, Greek residents are not able to play any major online poker tournament at this time, other than the ones restricted to Greek players.

According to reports though, this ring fenced policy does not apply to cash games, where Greeks can still compete with foreign players. Question is, for how long?

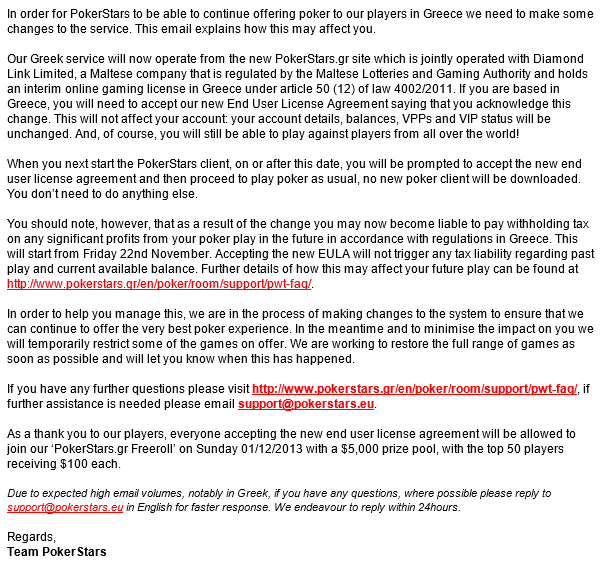

This is the email that Pokerstars sent to their Greek customers:

Pokerstars and FullTilt poker players living in Greece are enraged of this development. They complain both about the unfair tax and Pokerstars, who implemented the change without a warning. At the time of writing plenty of Greek players are reporting they are considering to withdraw their money. At least, withdrawals seem to be processed in a timely manner.

Another question is how Pokerstars operated the previous months and why these changes took place now.